What You Should Know about a Seller’s Permit

A business needs a seller’s permit to sell services or products and get sales tax. The reason for the permit is to allow the state to control the process of reporting, collecting, and paying sales tax. Sales tax is just one of the taxes that a business will have to deal with. This type of permit can also be called a resale permit or a permit license.

What’s the Difference between This and a Wholesale Certificate?

This type of permit and a resale, or wholesale, certificate are two different things. Many businesses will buy materials or products for resale purposes. These purchases aren’t taxable in some states and the tax is then paid when the retailer resells the items. In this case, the retailer will need a wholesale certificate.

Do You Need This Permit?

If you plan to sell any services or products, then you need to get a seller’s permit. If you have a business, you should apply for a permit even if you think you don’t need to collect sales tax. You will also need this permit to accept certificates for sales tax exemptions. Many states don’t have a sales tax statewide, so you won’t need to get a permit in these states.

Before Applying for Your Permit

In order to make the process go smoother, it helps if you have the information ready for your permit. You will need to get a tax ID number for your business as well as an employer ID, even if you don’t have employees. You will also need to show the NAICS code for all different services and products you produce since the government classifies businesses by the types of services and products they provide. You will also need to include information about your business that should be readily available.

How to Get This Permit

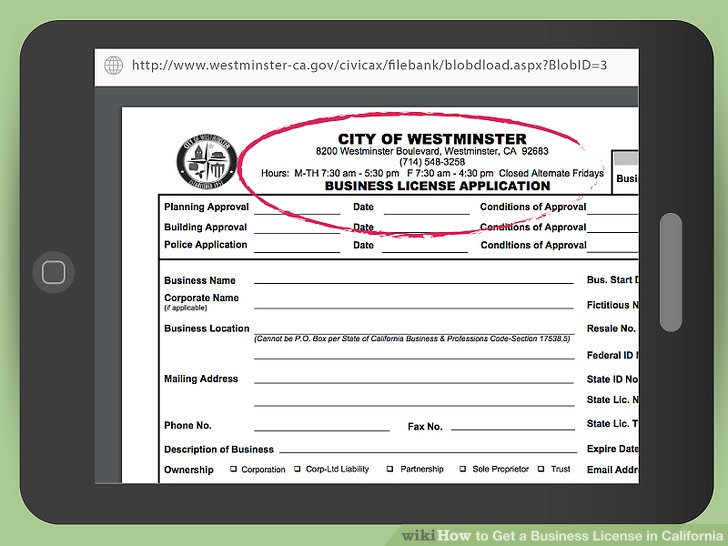

Many states will allow applying for this permit and filing the application online. Go to your state’s State Department of Revenue to find the online information. You will be asked some common questions about your business. These questions can include your business name and any previous business entity, if your business is seasonal, the types of services and products to be sold, and the amount of sales tax you estimate you will collect. In addition to providing information about your business, you will need to submit documents for verification purposes, such as your Social Security Number, a copy of your driver’s license, and the location and name of the bank where you have an account. Some states will charge a fee for registration while others don’t. Each state has different requirements for getting a seller’s permit and you may be asked additional questions depending on your state.